These days it seems a jack hammer has been taken to the nation’s hardest-hit housing markets:

hundreds of thousands of foreclosed properties are selling, with four

times as many potential foreclosures behind them.

The Journal writes today that one idea gaining support in

Washington is an effort to pull some of those properties off the market and rent

them out, either on homes owned by federal agencies or loan giants Fannie Mae

and Freddie Mac.

The big time firms and U.S. banks currently own more than 500,000 foreclosed homes,

with another 2 million loans in some stage of the foreclosure process. The high share

of distressed sales in many struggling markets is contributing to continued

declines in home prices.

“Can we find a way to try and reduce that overhang or to try to provide

incentives for investors to covert them?” said Federal Reserve Chairman Ben

Bernanke in testimony to Congress last week.

Secptics worry about a risk of the government as the landlord. One solution:

sell federally backed foreclosures to investors who would have to agree to rent

them out for a to-be-determined period of time. Investors would rehab the

properties, fill them with tenants, and hire a national property management firm

to oversee the day-to-day landlord needs.

Supporters say while the government isn’t set up to be a landlord, neither is

it any better prepared to sell thousands of foreclosed properties — something

it’s already doing anyway. “Putting these homes in the hands of people who can

take care of them and rent them out” would save taxpayer money, says John Burns,

who runs a home-building consulting firm in Irvine, Calif.

So far, the Fannie and Freddie have disappointed institutional investors by

resisting selling homes in bulk at deep discounts. Instead, foreclosures are

either sold through regular retail listings or in public auctions, known as

trustee or sheriff sales. Those auctions have attracted primarily mom-and-pop

investors but also include hedge fund-backed debt buyers.

Over the last two years, investors increasingly have scooped up cheap properties at auctions

in the hopes of rehabbing and quickly reselling them for a profit. But declining

home values — and increased competition from investors — has made the process difficult.

Meanwhile, the discounts for foreclosed properties in some markets are so

attractive “that it looks like the cash flow investors are getting [on rentals]

is awfully good,” says Thomas Lawler, an independent housing economist in

Leesburg, Va.

One sign that investor demand has picked up for cheap properties that can be

rented: in Phoenix, the number of homes selling below $100,000 was up 41% from

one year ago in May, while all other sales were down 11.3%, according to

DataQuick, a real-estate data firm.

“It doesn’t take too long as an investor to recognize the opportunity: home

prices are less, but rents are more,” says Eric Peterson, a former homebuilder

and co-founder of Praxis Capital, which has launched a $10 million fund focused

on renting out foreclosures. Once prices stabilize and begin rising in a few

years, “we’ll be holding a fair amount of inventory, and we’ll be ready to

sell.”

This idea has won backing from a number of influential private company’s.

Creating rental programs could “solve a couple of policy problems with one solution” by

also extending qualified tenants an option to one day purchase the homes, said

mortgage-bond pioneer Lewis Ranieri in a recent paper with Kenneth Rosen, a

housing economist at the University of California at Berkeley.

People are now finding it is better to Short sale their homes, and to get out from under water in thier current house. Choosing to rent for a few years while fixing your credit will give you a better chance at finding the right home for your income and family needs in the future. giving you a possitive experience when you caome back to the buying market.

What are your thought on Renting compared to home buying?

Logo

GreenHouseProperties

Friday, July 29, 2011

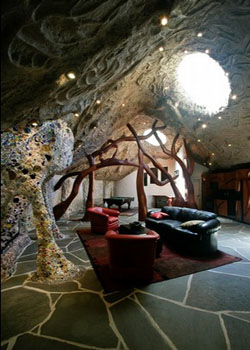

Super Stars Humongous Homes

Super Stars and their super homes…… when is enough, enough?

It’s 5,099 air miles from Tampa, Florida to Venice, Italy. But Ryan Howard found a much faster way to see the legendary Venetian canals: he’s building one in his new home.

A town not far from Tampa is considering a major change to its housing code to allow the Phillies slugger to build a $23 million, 17,500-square-foot home nicknamed Casa Del Howard.

The Philadelphia Daily News reports (via the Tampa Bay Weekly) Howard’s architect had to testify before a town commission about the ridiculous plans for the house. At issue is the length of construction. City code says all homes must be finished in 24 months; the Howard palace could take as long as 3 1/2 years to complete.

Dan Dawson says the gulf-front property, covering over an acre of land in Belleair, Florida, features a Venice-style lazy river running from the swimming pool underneath a series of bridges. In case you believe Howard could do without the Italian influence on his home, Dawson told the commission the river is “a fundamental part of the design.” He claimed the whole Howard family was looking forward to seeing the canal, and won’t consider dropping it from the plans.

If Howard gets bored with baseball, he can try the Pro Bowling Tour. His castle will include a bowling alley on the ground level with breakaway walls.

Belleair is considering its options. The town could amend the law, or the ordinance could be left as is, and the case appealed to the special magistrate when the six month deadline is not met.

Howard has earned $45,255,000 over the course of his big league career, which began in 2006. The St. Louis native will earn $115,000,000 in guaranteed money from 2012 through 2016 from the Phillies.

While the 17,500 square foot home is silly in size, it’s small next to Derek Jeter’s new plantation.

Jeter made headlines in Tampa with his $7.7 million, 30,875 square foot mansion nicknamed “St. Jetersburg,” that’s said to be close to the size of a Best Buy electronics store and is the biggest house, square-footage-wise, in the country.

The average family tends to be happy living in their three bedroom two bath home with a pool. But when you are an Iconic super star a private Vemice, Italy will have to sufice. I do not dissagree that a bowling alley in your own home sounds like a good time. However, could a 30,000 or even a 17,000 square foot home really be considered economicly or organicaly a good choice? When your making $115,000,000 though do you really care?

What are your thoughts on Celebrity homes?

It’s 5,099 air miles from Tampa, Florida to Venice, Italy. But Ryan Howard found a much faster way to see the legendary Venetian canals: he’s building one in his new home.

A town not far from Tampa is considering a major change to its housing code to allow the Phillies slugger to build a $23 million, 17,500-square-foot home nicknamed Casa Del Howard.

The Philadelphia Daily News reports (via the Tampa Bay Weekly) Howard’s architect had to testify before a town commission about the ridiculous plans for the house. At issue is the length of construction. City code says all homes must be finished in 24 months; the Howard palace could take as long as 3 1/2 years to complete.

Dan Dawson says the gulf-front property, covering over an acre of land in Belleair, Florida, features a Venice-style lazy river running from the swimming pool underneath a series of bridges. In case you believe Howard could do without the Italian influence on his home, Dawson told the commission the river is “a fundamental part of the design.” He claimed the whole Howard family was looking forward to seeing the canal, and won’t consider dropping it from the plans.

If Howard gets bored with baseball, he can try the Pro Bowling Tour. His castle will include a bowling alley on the ground level with breakaway walls.

Belleair is considering its options. The town could amend the law, or the ordinance could be left as is, and the case appealed to the special magistrate when the six month deadline is not met.

Howard has earned $45,255,000 over the course of his big league career, which began in 2006. The St. Louis native will earn $115,000,000 in guaranteed money from 2012 through 2016 from the Phillies.

While the 17,500 square foot home is silly in size, it’s small next to Derek Jeter’s new plantation.

Jeter made headlines in Tampa with his $7.7 million, 30,875 square foot mansion nicknamed “St. Jetersburg,” that’s said to be close to the size of a Best Buy electronics store and is the biggest house, square-footage-wise, in the country.

The average family tends to be happy living in their three bedroom two bath home with a pool. But when you are an Iconic super star a private Vemice, Italy will have to sufice. I do not dissagree that a bowling alley in your own home sounds like a good time. However, could a 30,000 or even a 17,000 square foot home really be considered economicly or organicaly a good choice? When your making $115,000,000 though do you really care?

What are your thoughts on Celebrity homes?

Thursday, July 28, 2011

1245 Barstow

Stuck in Phoenix, the Epicenter of Housing Crisis

In metropolitan Phoenix, 2/3 of all residential mortgages are underwater. Of these, some 200,000 are 50% larger than the current market value of the properties. Many homeowners have come to doubt whether they'll ever retrieve their lost equity.

A city with population of 4 million, the 14th largest in the United States, the median home price is down 53% since the bubble peaked in 2006 to just over $120,000. Only smaller cities such as Las Vegas and Orlando have witnessed equally catastrophic drops.

Paul Hickman, the head of the Arizona Bankers Association, says for Arizona the current recession is worse than the Great Depression of the 1930s. "Then," he told Cronkite News of Arizona State University, "our economy was young and we were just barely a state." Now, he says, Arizona is suffering because it became excessively dependent on a "one-dimensional housing economy."

Phoenix is no stranger to booms and busts. Home prices here fell in the late 1980s after the savings-and-loan debacle brought down several local developers, including the notorious Charles Keating of Keating Five fame. Now 88, Keating lives quietly in Phoenix, having served a 4½-year prison term for fraud after his Lincoln Savings and Loan collapsed in 1989.

The scope and severity of the current crisis easily eclipses that of the '80s and '90s. Phoenix's population is now 45% larger and, as new suburbs begin to encroached ever farther into the desert, residents have been squeezed by long commutes and the sharp run up in gas prices. Housing economist and retired ASU professor Jay Butler says of the current downturn, "nobody thought it could get this bad." He foresees no significant recovery for two more years.

Some local realtors dispute that pessimistic assessment. They point to strong existing home sales in June, up 22% according to the National Association of Realtors. It was the second consecutive month of strong sales, with the June figure the strongest recorded since December 2006.

But while sales may be up, prices are not. The NAR report says the median price of a home sold in the Phoenix area in June was down 13% from the same month in 2010. Realtor Robert Holt expects prices to remain weak because distressed properties are accounting for 64% of sales. With Phoenix having an inventory of over 120,000 empty or foreclosed homes, Holt expects "a tidal wave of foreclosures" will soon hit the market. He says with "overall mortgage delinquencies double and foreclosures eight times higher than historical norms, there is not going to be any easy or quick fix to the housing crisis."

Laurie Goodman, the respected mortgage market analyst at Amherst Securities, sees a similar problem nationally. Alarmed at what she believes is a 30-month supply of distressed properties overhanging the market, she told an American Enterprise Institute conference recently, "we're not making enough progress in liquidating bad loans."

Saying that only 30% of troubled loans have been resolved, she predicts that over the next six years as many as one out of every five mortgage holders in the country could lose their homes. With the number of distressed properties coming to market not keeping pace with a mounting inventory of troubled mortgages, and prospective buyers finding it hard to get credit, the normal supply/demand function in housing is broken, says Goodman.

She argues that the result is likely a boom in rental housing as strategic defaulters and evictees gravitate to cheaper rental homes. "Rental rates are rising," she says, "because renting is the only way to absorb the overhang."

In Phoenix, that is already happening. As home prices declined over the past year, rental rates rose 9%. Nearly half of the distressed homes sold over the past year have been turned into rentals. Michael Trailor, the director of the Arizona Housing Department, says "the shift from home ownership to rentals in the Valley will continue as home ownership shrinks more."

Ironically perhaps, the shift to rentals is occurring while home affordability has improved. With home prices way down and mortgage interest rates very low, this is the best time in at least 20 years to buy. In Phoenix prices have slid back to the levels that prevailed in 1998 or 2000.

Adam Stankus, a hotel manager in Tempe, and his schoolteacher wife are in the enviable position of being prospective buyers in a buyers' market. They hope to purchase the home they currently rent in the suburb of Buckeye for under $50,000. Lucky to have savings equal to a 20% down payment, Stankus believes their monthly mortgage payment will be well below their $800 monthly rent.

The unexpectedly severe downturn over the last five years shows that nobody really knows the future direction of the housing market. Gary Shilling, a respected forecaster, is predicting that prices could fall another 20% nationally, on top of the 30% decline that has already occurred. Mark Zandi, meanwhile, of Moody's Analytics believes we're already bumping along the bottom and that prices could begin to recover next year.

Robert Holt, the north Phoenix realtor, argues persuasively that there won't be a price upturn in his market until the ingredients for a recovery are in place. These, he says, include population growth and an increase in jobs. Currently, that isn't happening. The local unemployment rate is stuck at around 8%. While below the national average, only 4,900 jobs were added in the past year. Given all that, ASU professor Butler says the "housing recovery in Phoenix is likely to improve at only a glacial pace."

http://finance.yahoo.com/real-estate/article/113212/phoenix-epicenter-housing-crisis-marketwatch?mod=realestate-sell

A city with population of 4 million, the 14th largest in the United States, the median home price is down 53% since the bubble peaked in 2006 to just over $120,000. Only smaller cities such as Las Vegas and Orlando have witnessed equally catastrophic drops.

Paul Hickman, the head of the Arizona Bankers Association, says for Arizona the current recession is worse than the Great Depression of the 1930s. "Then," he told Cronkite News of Arizona State University, "our economy was young and we were just barely a state." Now, he says, Arizona is suffering because it became excessively dependent on a "one-dimensional housing economy."

Phoenix is no stranger to booms and busts. Home prices here fell in the late 1980s after the savings-and-loan debacle brought down several local developers, including the notorious Charles Keating of Keating Five fame. Now 88, Keating lives quietly in Phoenix, having served a 4½-year prison term for fraud after his Lincoln Savings and Loan collapsed in 1989.

The scope and severity of the current crisis easily eclipses that of the '80s and '90s. Phoenix's population is now 45% larger and, as new suburbs begin to encroached ever farther into the desert, residents have been squeezed by long commutes and the sharp run up in gas prices. Housing economist and retired ASU professor Jay Butler says of the current downturn, "nobody thought it could get this bad." He foresees no significant recovery for two more years.

Some local realtors dispute that pessimistic assessment. They point to strong existing home sales in June, up 22% according to the National Association of Realtors. It was the second consecutive month of strong sales, with the June figure the strongest recorded since December 2006.

But while sales may be up, prices are not. The NAR report says the median price of a home sold in the Phoenix area in June was down 13% from the same month in 2010. Realtor Robert Holt expects prices to remain weak because distressed properties are accounting for 64% of sales. With Phoenix having an inventory of over 120,000 empty or foreclosed homes, Holt expects "a tidal wave of foreclosures" will soon hit the market. He says with "overall mortgage delinquencies double and foreclosures eight times higher than historical norms, there is not going to be any easy or quick fix to the housing crisis."

Laurie Goodman, the respected mortgage market analyst at Amherst Securities, sees a similar problem nationally. Alarmed at what she believes is a 30-month supply of distressed properties overhanging the market, she told an American Enterprise Institute conference recently, "we're not making enough progress in liquidating bad loans."

Saying that only 30% of troubled loans have been resolved, she predicts that over the next six years as many as one out of every five mortgage holders in the country could lose their homes. With the number of distressed properties coming to market not keeping pace with a mounting inventory of troubled mortgages, and prospective buyers finding it hard to get credit, the normal supply/demand function in housing is broken, says Goodman.

She argues that the result is likely a boom in rental housing as strategic defaulters and evictees gravitate to cheaper rental homes. "Rental rates are rising," she says, "because renting is the only way to absorb the overhang."

In Phoenix, that is already happening. As home prices declined over the past year, rental rates rose 9%. Nearly half of the distressed homes sold over the past year have been turned into rentals. Michael Trailor, the director of the Arizona Housing Department, says "the shift from home ownership to rentals in the Valley will continue as home ownership shrinks more."

Ironically perhaps, the shift to rentals is occurring while home affordability has improved. With home prices way down and mortgage interest rates very low, this is the best time in at least 20 years to buy. In Phoenix prices have slid back to the levels that prevailed in 1998 or 2000.

Adam Stankus, a hotel manager in Tempe, and his schoolteacher wife are in the enviable position of being prospective buyers in a buyers' market. They hope to purchase the home they currently rent in the suburb of Buckeye for under $50,000. Lucky to have savings equal to a 20% down payment, Stankus believes their monthly mortgage payment will be well below their $800 monthly rent.

The unexpectedly severe downturn over the last five years shows that nobody really knows the future direction of the housing market. Gary Shilling, a respected forecaster, is predicting that prices could fall another 20% nationally, on top of the 30% decline that has already occurred. Mark Zandi, meanwhile, of Moody's Analytics believes we're already bumping along the bottom and that prices could begin to recover next year.

Robert Holt, the north Phoenix realtor, argues persuasively that there won't be a price upturn in his market until the ingredients for a recovery are in place. These, he says, include population growth and an increase in jobs. Currently, that isn't happening. The local unemployment rate is stuck at around 8%. While below the national average, only 4,900 jobs were added in the past year. Given all that, ASU professor Butler says the "housing recovery in Phoenix is likely to improve at only a glacial pace."

http://finance.yahoo.com/real-estate/article/113212/phoenix-epicenter-housing-crisis-marketwatch?mod=realestate-sell

3 true stories of hidden treasures

From a million-dollar nickel to a hidden surprise in the attic, MainStreet readers share their incredible true stories of found treasure.

When we stumble upon a penny in the street, we tend to shrug it off, thinking that it’s pointless to stop and pick it up. After all, we tell ourselves, how much is a penny worth, anyway?

But imagine if that penny were a nickel, and not just any nickel, but an extremely rare one that had been sought after by numismatics for years and was valued at $2.5 million. Ryan Givens’s uncle, the famed collector George Walton, possessed such a coin, but when his estate left the nickel to Givens’s mother, it ended up sitting in her closet gathering dust for nearly four decades until Givens was prodded to take a second look.

MainStreet decided to look at what it means to “luck into” found treasure, and all the exciting ways this can happen. From Givens’s heartwarming tale of the Liberty Head nickel that vindicated his uncle to a historical ranch in Lampasas, Texas, that literally abounds with buried treasure, MainStreet is excited to share three tales that are sure to boggle your mind and inspire you to clean out your closet.

Up in the Attic

Steven Hoffer had a hunch there was treasure lurking in his parents’ attic when he dropped by one day to sort through the many boxes that had been sitting there, sealed, for nearly 30 years.

“I was an only child, an odd kid,” says the part-time recording artist from a suburb outside of San Francisco. “I always kept track of my toys really well, everything I had I really saved. But once you grow up and see that you have stuff, you watch shows and you want to get as much money as you can.”

The “sea of boxes” crowding his parents’ attic were mostly labeled 1975 or 1976, but many were filled with belongings dating to 1977, the year when an epic space opera from George Lucas sparked a serious toy obsession for Hoffer.

“It was almost like found money,” the composer says of the 50 sets of first edition Star Wars toys he found in the attic. “Instantly, it’s like I had this investment that I was forced to now manage and make proper decisions on. I found that I’m sitting on a gold mine that’s worth up to $10,000.”

Hoffer took it upon himself to thoroughly research the toys and sell them in bulk to a comic book store in San Francisco.

“They were blown away, but didn’t want to show their full enthusiasm,” he recounts of the sellers, especially since he’s been told by friends that the collectors market is tough. But for Hoffer, the items were an unexpected windfall that came at a rather tough time.

“I have friends that tell me, ‘Hold onto this, maybe the value will go up in 20 years or so’,” he says. “But I work in the music industry and things are tight right now, so I definitely see this as a way of supplementing my income. This investment was dumped on my lap. I don’t have a personal attachment.”

Buried Treasure

Lampasas, Texas: Locals call it Hill Country, a lush expanse of rolling hills, but to Pablo and Beverly Solomon, it’s home to their historic, sprawling ranch built in 1856–and roughly 50 acres of buried treasure.

“It’s a state historic site, though it’s privately owned,” Pablo, a sculptor, explains in his trademark drawl. “Any time we dig in the yard for any reason, whether it’s to put in a phone line or plant a tree, we’ve found coins going as far back the Civil War. We found a Confederate cavalry spur for boots, lots of old boots, really old toys, some cast-iron toys that were well over 100 years old.”

And the list doesn’t end there. The Solomons have found old tools, cast-iron goods hand-forged by a blacksmith dating back to the 18th century, old hand forks (a gardening tool), toys and even Native American artifacts that are 2,000-7,000 years old.

“We’ve found some really nice Indian arrowheads,” Solomon says, “plus a grindstone and grinding bowl. We found a little porcelain doll, probably from Germany, and one time we found an old Christmas ornament that was stamped, I want to say 1880.”

While it’s legal to sell “found treasure” from state historical sites in Texas, Solomon and his wife choose not to do so, instead viewing the bounty as a token of the house they bought in 1988.

“We choose not to sell them because they’re important to us,” Solomon says. “We like to hang them on our walls.”

The $2 Million Nickel

George Walton loved nothing more than collecting rare coins, and when the North Carolina dealer was killed in a car accident in 1962, his extended family inherited a princely sum.

Among the pieces was one of five Liberty Head nickels bearing the date 1913.

As the story goes, the main U.S. coin between 1883 and 1912 was the Liberty Head, which was replaced in 1913 by the Indian/Buffalo coin.

“There weren’t supposed to be any 1913 Liberty Head nickels made,” Givens explains, “but there was a period of time that the U.S. Mint said, ‘Let’s wait and see what we can do with it,’” and the Mint held onto the dies.

About five years later, a U.S. Mint employee used the dies to create five 1913 Liberty Head coins, perhaps in a shady move to trigger his own collecting craze. Givens says the Mint would contend they were never printed, but this made the coins even more desirable to collectors. When Walton lucked into the nickel in 1945, he cherished it with all his heart, taking great care to remind his family that he was sitting on a fortune.

Givens never doubted Uncle George, but the host of auctioneers who appraised the nickel in 1962 after Walton’s death felt differently. Something was amiss, and so it was left to gather dust in Givens’s mother’s closet, where she kept it for 40 years.

In 1992, Givens’ mother passed away and in a strange twist of fate, the coin collecting community renewed its interest in the mysterious nickels, which were now said to be worth millions.

“I didn’t pay attention to it until a gentleman asked me if I had it or knew where it was,” says Givens. “He offered $5,000, but I told him I couldn’t sell it and he’d have to ask my family.”

But Givens couldn’t shake the idea that the nickel might be the real thing. When the fourth Liberty Head nickel sold in 1993, he had to find out for sure.

“It was fun to imagine it to be real, even though I knew it wasn’t, but the more I looked at it, the more I couldn’t find anything wrong with it,” he says.

Ten years later, it all came together.

On a fateful night, Givens attended the American Numismatic Association’s annual convention in July, where there was to be a great display of all four Liberty Head nickels. A little while before an editor at Coin World had wanted to do a piece on the altered-date coins, and had her reporter tap Givens’s sister, Cheryl Myers, for an interview about Uncle George. The editor also had an idea to have Myers feature the coin in the ANA’s display because after all, it was part of the story.

But what happened next took everyone by surprise.

In an effort to find the missing nickel, the coin dealing firm Bowers and Merena, with the help of Donn Pearlman, offered a $1 million bounty to whoever could come forward with the authentic piece. With all the coins now in one place at the convention, a group of six professional appraisers, as well as Pearlman and Givens, examined Walton’s coin. And after hours of comparing and contrasting, what they found took the coin collecting world by storm—the coin was the one.

“It vindicated Uncle George,” says Givens.

Today, the George Walton Nickel is still owned by the Givens family, but travels to exhibits around the country. It is currently on display at the Money Museum in Colorado.

It’s just an interesting coin to look at, and from our point of view, it’s even more interesting because of the mystery of when they tried to authenticate it in 1962,” Givens says. “It’s something that’s done a lot for the family, and it was good for my uncle—usually people forget collectors, but his name came back in the news. Mainly it’s the story behind it, what’s happened to it, where it’s been.”

http://finance.yahoo.com/family-home/article/113186/true-stories-hidden-treasure-mainstreet

When we stumble upon a penny in the street, we tend to shrug it off, thinking that it’s pointless to stop and pick it up. After all, we tell ourselves, how much is a penny worth, anyway?

MainStreet decided to look at what it means to “luck into” found treasure, and all the exciting ways this can happen. From Givens’s heartwarming tale of the Liberty Head nickel that vindicated his uncle to a historical ranch in Lampasas, Texas, that literally abounds with buried treasure, MainStreet is excited to share three tales that are sure to boggle your mind and inspire you to clean out your closet.

Up in the Attic

Steven Hoffer had a hunch there was treasure lurking in his parents’ attic when he dropped by one day to sort through the many boxes that had been sitting there, sealed, for nearly 30 years.

“I was an only child, an odd kid,” says the part-time recording artist from a suburb outside of San Francisco. “I always kept track of my toys really well, everything I had I really saved. But once you grow up and see that you have stuff, you watch shows and you want to get as much money as you can.”

The “sea of boxes” crowding his parents’ attic were mostly labeled 1975 or 1976, but many were filled with belongings dating to 1977, the year when an epic space opera from George Lucas sparked a serious toy obsession for Hoffer.

“It was almost like found money,” the composer says of the 50 sets of first edition Star Wars toys he found in the attic. “Instantly, it’s like I had this investment that I was forced to now manage and make proper decisions on. I found that I’m sitting on a gold mine that’s worth up to $10,000.”

Hoffer took it upon himself to thoroughly research the toys and sell them in bulk to a comic book store in San Francisco.

“They were blown away, but didn’t want to show their full enthusiasm,” he recounts of the sellers, especially since he’s been told by friends that the collectors market is tough. But for Hoffer, the items were an unexpected windfall that came at a rather tough time.

“I have friends that tell me, ‘Hold onto this, maybe the value will go up in 20 years or so’,” he says. “But I work in the music industry and things are tight right now, so I definitely see this as a way of supplementing my income. This investment was dumped on my lap. I don’t have a personal attachment.”

Buried Treasure

Lampasas, Texas: Locals call it Hill Country, a lush expanse of rolling hills, but to Pablo and Beverly Solomon, it’s home to their historic, sprawling ranch built in 1856–and roughly 50 acres of buried treasure.

“It’s a state historic site, though it’s privately owned,” Pablo, a sculptor, explains in his trademark drawl. “Any time we dig in the yard for any reason, whether it’s to put in a phone line or plant a tree, we’ve found coins going as far back the Civil War. We found a Confederate cavalry spur for boots, lots of old boots, really old toys, some cast-iron toys that were well over 100 years old.”

And the list doesn’t end there. The Solomons have found old tools, cast-iron goods hand-forged by a blacksmith dating back to the 18th century, old hand forks (a gardening tool), toys and even Native American artifacts that are 2,000-7,000 years old.

“We’ve found some really nice Indian arrowheads,” Solomon says, “plus a grindstone and grinding bowl. We found a little porcelain doll, probably from Germany, and one time we found an old Christmas ornament that was stamped, I want to say 1880.”

While it’s legal to sell “found treasure” from state historical sites in Texas, Solomon and his wife choose not to do so, instead viewing the bounty as a token of the house they bought in 1988.

“We choose not to sell them because they’re important to us,” Solomon says. “We like to hang them on our walls.”

The $2 Million Nickel

George Walton loved nothing more than collecting rare coins, and when the North Carolina dealer was killed in a car accident in 1962, his extended family inherited a princely sum.

Among the pieces was one of five Liberty Head nickels bearing the date 1913.

As the story goes, the main U.S. coin between 1883 and 1912 was the Liberty Head, which was replaced in 1913 by the Indian/Buffalo coin.

“There weren’t supposed to be any 1913 Liberty Head nickels made,” Givens explains, “but there was a period of time that the U.S. Mint said, ‘Let’s wait and see what we can do with it,’” and the Mint held onto the dies.

About five years later, a U.S. Mint employee used the dies to create five 1913 Liberty Head coins, perhaps in a shady move to trigger his own collecting craze. Givens says the Mint would contend they were never printed, but this made the coins even more desirable to collectors. When Walton lucked into the nickel in 1945, he cherished it with all his heart, taking great care to remind his family that he was sitting on a fortune.

Givens never doubted Uncle George, but the host of auctioneers who appraised the nickel in 1962 after Walton’s death felt differently. Something was amiss, and so it was left to gather dust in Givens’s mother’s closet, where she kept it for 40 years.

In 1992, Givens’ mother passed away and in a strange twist of fate, the coin collecting community renewed its interest in the mysterious nickels, which were now said to be worth millions.

“I didn’t pay attention to it until a gentleman asked me if I had it or knew where it was,” says Givens. “He offered $5,000, but I told him I couldn’t sell it and he’d have to ask my family.”

But Givens couldn’t shake the idea that the nickel might be the real thing. When the fourth Liberty Head nickel sold in 1993, he had to find out for sure.

“It was fun to imagine it to be real, even though I knew it wasn’t, but the more I looked at it, the more I couldn’t find anything wrong with it,” he says.

Ten years later, it all came together.

On a fateful night, Givens attended the American Numismatic Association’s annual convention in July, where there was to be a great display of all four Liberty Head nickels. A little while before an editor at Coin World had wanted to do a piece on the altered-date coins, and had her reporter tap Givens’s sister, Cheryl Myers, for an interview about Uncle George. The editor also had an idea to have Myers feature the coin in the ANA’s display because after all, it was part of the story.

But what happened next took everyone by surprise.

In an effort to find the missing nickel, the coin dealing firm Bowers and Merena, with the help of Donn Pearlman, offered a $1 million bounty to whoever could come forward with the authentic piece. With all the coins now in one place at the convention, a group of six professional appraisers, as well as Pearlman and Givens, examined Walton’s coin. And after hours of comparing and contrasting, what they found took the coin collecting world by storm—the coin was the one.

“It vindicated Uncle George,” says Givens.

Today, the George Walton Nickel is still owned by the Givens family, but travels to exhibits around the country. It is currently on display at the Money Museum in Colorado.

It’s just an interesting coin to look at, and from our point of view, it’s even more interesting because of the mystery of when they tried to authenticate it in 1962,” Givens says. “It’s something that’s done a lot for the family, and it was good for my uncle—usually people forget collectors, but his name came back in the news. Mainly it’s the story behind it, what’s happened to it, where it’s been.”

http://finance.yahoo.com/family-home/article/113186/true-stories-hidden-treasure-mainstreet

1245 W Barstow

Deadline Has Been Extended for HUD’s Emergency Homeowners’ Loan Program

HUD and NeighborWorks America have extended the deadline for homeowners Experiencing a loss of income to apply for the Emergency Homeowners’ Loan Program (EHLP).

The new application deadline is Wednesday, July 27. The cut-off date had originally been set for Friday, July 22.

EHLP assists homeowners who have experienced a reduction in income and are at risk of foreclosure due to involuntary unemployment or underemployment as a result of the economy or a medical condition.

Eligible homeowners can qualify for an interest free loan, which pays a portion of their monthly mortgage for up to two years, or up to $50,000, whichever comes first.

On June 20, HUD and NeighborWorks announced the roll-out of EHLP to 27 states across the country and Puerto Rico.

They have extended the window for struggling homeowners in these areas to submit their documentation for eligibility screening after some participating housing counseling agencies were not able to meet their market allocations for applicant entries.

The Emergency Homeowners’ Loan Program, which is providing assistance for all participating states through its national hotline, issued a statement on Friday noting that it has seen “seen a dramatic rise in applications to the Homeowner’s HOPE Hotline over the last 2 days from homeowners seeking EHLP—‐related information and assistance.”

“We are very grateful for the extension that will enable us to help so many more unemployed, underemployed, and medically challenged people apply for the program and hopefully stay in their homes,” said Colleen Hernandez, CEO of the nonprofit counseling organization.

Hernandez says the average EHLP loan is expected to be approximately $35,000. She also stressed that the loan is forgiven if the homeowner stays in the home for five years.

Congress provided $1 billion dollars to HUD, as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, to implement EHLP.

The program is available to home owners in the following states: Alaska, Arkansas, Colorado, Hawaii, Iowa, Kansas, Louisiana, Maine, Massachusetts, Minnesota, Missouri, Montana, Nebraska, New Hampshire, New Mexico, New York, North Dakota, Oklahoma, South Dakota, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming, as well as Puerto Rico.

HUD also identified five states — Connecticut, Delaware, Idaho, Maryland, and Pennsylvania — operating their own respective mortgage assistance programs that met HUD’s criteria as “substantially similar” to the EHLP. Each of these states has received direct allocations of EHLP funds to directly administer and assist homeowners in need through their own programs.

The new application deadline is Wednesday, July 27. The cut-off date had originally been set for Friday, July 22.

EHLP assists homeowners who have experienced a reduction in income and are at risk of foreclosure due to involuntary unemployment or underemployment as a result of the economy or a medical condition.

Eligible homeowners can qualify for an interest free loan, which pays a portion of their monthly mortgage for up to two years, or up to $50,000, whichever comes first.

On June 20, HUD and NeighborWorks announced the roll-out of EHLP to 27 states across the country and Puerto Rico.

They have extended the window for struggling homeowners in these areas to submit their documentation for eligibility screening after some participating housing counseling agencies were not able to meet their market allocations for applicant entries.

The Emergency Homeowners’ Loan Program, which is providing assistance for all participating states through its national hotline, issued a statement on Friday noting that it has seen “seen a dramatic rise in applications to the Homeowner’s HOPE Hotline over the last 2 days from homeowners seeking EHLP—‐related information and assistance.”

“We are very grateful for the extension that will enable us to help so many more unemployed, underemployed, and medically challenged people apply for the program and hopefully stay in their homes,” said Colleen Hernandez, CEO of the nonprofit counseling organization.

Hernandez says the average EHLP loan is expected to be approximately $35,000. She also stressed that the loan is forgiven if the homeowner stays in the home for five years.

Congress provided $1 billion dollars to HUD, as part of the Dodd-Frank Wall Street Reform and Consumer Protection Act, to implement EHLP.

The program is available to home owners in the following states: Alaska, Arkansas, Colorado, Hawaii, Iowa, Kansas, Louisiana, Maine, Massachusetts, Minnesota, Missouri, Montana, Nebraska, New Hampshire, New Mexico, New York, North Dakota, Oklahoma, South Dakota, Texas, Utah, Vermont, Virginia, Washington, West Virginia, Wisconsin, and Wyoming, as well as Puerto Rico.

HUD also identified five states — Connecticut, Delaware, Idaho, Maryland, and Pennsylvania — operating their own respective mortgage assistance programs that met HUD’s criteria as “substantially similar” to the EHLP. Each of these states has received direct allocations of EHLP funds to directly administer and assist homeowners in need through their own programs.

Fresno 93705 Hud

4044 N Crystal Ave.

$67,000

A 3 bedroom 1 bath

For more information call Green House Properties

559-478-2090

Julie Salinas

01440468

Housing occupancy declines, As rentals go up

Empty homes have been on the rise since the recession

and real estate bust, but occupancy is starting to pick up in some places —

largely because of soaring rental demand.

Neighborhoods from Tacoma, Wash., to New York’s Bronx

borough and parts of Albuquerque are showing an uptick in occupied housing,

according to an analysis of U.sS. Postal Service data.

“There are quite a lot of variations in how metropolitan

areas are weathering the current economic conditions,” says Justin Hollander,

urban planning professor at Tufts University who led the research conducted with the Lincoln Institute of Land Policy.

Hollander studied data on mail delivery to residences in

nearly 30,000 ZIP codes in the contiguous 48 states during the housing boom and

collapse. When a unit is vacant, the Postal Service scratches the address off

its delivery list.

Occupied housing has declined in about a third of ZIP codes

since 2009. From 2000 to 2006, before the recession hit, there were 26% fewer

postal areas that experienced an increase in vacant homes.

Suburban areas, where most new residential development was

concentrated during the real estate boom, were hit hard: The number of ZIP codes

in the suburbs that suffered drops in occupancy grew the most in the latter half

of the decade.

“Across the southern United States from Atlanta to Fort Myers (Fla.) to Phoenix, massive new housing

developments are largely unoccupied, while older housing is abandoned due to

foreclosure,” Hollander says.

But the nobody-home phenomenon haunting more and more

neighborhoods across the USA is reversing in some cities:

•Tacoma, Wash. The merger of Fort Lewisand McChord Air Force Base into joint last year has created one of the largest military

facilities in the world.

A community now numbering almost 34,000 active-duty

military personnel and 5,100 reservists, 49,500 family members, more than 29,000

military retirees and 15,000-plus civil service personnel and contractors all of

whom need housing.

“Our rental market is very strong,” says Raelene Rogers of

McCament and Rogers, a real estate consultant in Tacoma and the suburb of

Lakewood.

So strong that rental occupancy is at 98%, she says.

A condominium project in downtown Tacoma has been converted

into a 50-unit rental and is filled, mostly with military.

Over the past several months, 30,000 military contractors and

others have needed temporary off-base housing.

The city has not been immune to housing market woes,

however. Prices have fallen 30%.

“People who couldn’t sell their houses are renting,” Rogers

says.

•The Bronx. Astronomical housing prices in Manhattan

have pushed residents — many of them Dominican immigrants — into the adjacent

borough.

“Many are priced out as Manhattan continues to gentrify,”

says Bronx Councilman James Vacca. “In South Bronx and West Bronx, there’s a

pent-up demand for rentals.”

The housing market soared in 2002, as the demand for home

ownership was so high that older single-family homes on big lots on the east and

north sides were torn down and three or four new ones built in their place.

Housing units multiplied so much that Vacca led the charge to limit development

through zoning changes.

“Many of these row houses that went up came without parking

or adequate parking,” he says. Some units had nine cars per household.

Hollander’s analysis shows some Bronx ZIP codes have added

more than 1,000 occupied units since 2006.

•The New Orleans hurricane Katrina devastated the city in 2005 and housing occupancy plummeted in

almost every ZIP code from 2006 to 2009. In 70117, home of the decimated Lower Ninth Ward

, the number of occupied homes dropped by more than 9,500 during

that time.

There are signs of recovery: 1,799 more occupied units in

that ZIP from 2009 to 2011. In 70122, where the Gentilly Terrace and St. Bernard

Area neighborhoods are, there were almost 3,500 more occupied housing units in

2011 than in 2009.

•Albuquerque. Janice McCrary, executive vice

president of the Greater Albuquerque Association of Realtors, does not mince

words: “New-home building is probably dead in Albuquerque.”

Yet one ZIP code (87114) on the city’s far west side has

added more than 3,800 occupied units since 2006. Others, in older, more

established neighborhoods, have added more than 700.

and real estate bust, but occupancy is starting to pick up in some places —

largely because of soaring rental demand.

Neighborhoods from Tacoma, Wash., to New York’s Bronx

borough and parts of Albuquerque are showing an uptick in occupied housing,

according to an analysis of U.sS. Postal Service data.

“There are quite a lot of variations in how metropolitan

areas are weathering the current economic conditions,” says Justin Hollander,

urban planning professor at Tufts University who led the research conducted with the Lincoln Institute of Land Policy.

Hollander studied data on mail delivery to residences in

nearly 30,000 ZIP codes in the contiguous 48 states during the housing boom and

collapse. When a unit is vacant, the Postal Service scratches the address off

its delivery list.

Occupied housing has declined in about a third of ZIP codes

since 2009. From 2000 to 2006, before the recession hit, there were 26% fewer

postal areas that experienced an increase in vacant homes.

Widespread decline

Percentage of ZIP codes that registered a net decline in housing occupancy

from February 2009 through February 2011:

from February 2009 through February 2011:

concentrated during the real estate boom, were hit hard: The number of ZIP codes

in the suburbs that suffered drops in occupancy grew the most in the latter half

of the decade.

“Across the southern United States from Atlanta to Fort Myers (Fla.) to Phoenix, massive new housing

developments are largely unoccupied, while older housing is abandoned due to

foreclosure,” Hollander says.

But the nobody-home phenomenon haunting more and more

neighborhoods across the USA is reversing in some cities:

•Tacoma, Wash. The merger of Fort Lewisand McChord Air Force Base into joint last year has created one of the largest military

facilities in the world.

A community now numbering almost 34,000 active-duty

military personnel and 5,100 reservists, 49,500 family members, more than 29,000

military retirees and 15,000-plus civil service personnel and contractors all of

whom need housing.

“Our rental market is very strong,” says Raelene Rogers of

McCament and Rogers, a real estate consultant in Tacoma and the suburb of

Lakewood.

So strong that rental occupancy is at 98%, she says.

A condominium project in downtown Tacoma has been converted

into a 50-unit rental and is filled, mostly with military.

Over the past several months, 30,000 military contractors and

others have needed temporary off-base housing.

The city has not been immune to housing market woes,

however. Prices have fallen 30%.

“People who couldn’t sell their houses are renting,” Rogers

says.

•The Bronx. Astronomical housing prices in Manhattan

have pushed residents — many of them Dominican immigrants — into the adjacent

borough.

“Many are priced out as Manhattan continues to gentrify,”

says Bronx Councilman James Vacca. “In South Bronx and West Bronx, there’s a

pent-up demand for rentals.”

The housing market soared in 2002, as the demand for home

ownership was so high that older single-family homes on big lots on the east and

north sides were torn down and three or four new ones built in their place.

Housing units multiplied so much that Vacca led the charge to limit development

through zoning changes.

“Many of these row houses that went up came without parking

or adequate parking,” he says. Some units had nine cars per household.

Hollander’s analysis shows some Bronx ZIP codes have added

more than 1,000 occupied units since 2006.

•The New Orleans hurricane Katrina devastated the city in 2005 and housing occupancy plummeted in

almost every ZIP code from 2006 to 2009. In 70117, home of the decimated Lower Ninth Ward

, the number of occupied homes dropped by more than 9,500 during

that time.

There are signs of recovery: 1,799 more occupied units in

that ZIP from 2009 to 2011. In 70122, where the Gentilly Terrace and St. Bernard

Area neighborhoods are, there were almost 3,500 more occupied housing units in

2011 than in 2009.

•Albuquerque. Janice McCrary, executive vice

president of the Greater Albuquerque Association of Realtors, does not mince

words: “New-home building is probably dead in Albuquerque.”

Yet one ZIP code (87114) on the city’s far west side has

added more than 3,800 occupied units since 2006. Others, in older, more

established neighborhoods, have added more than 700.

How fence-sitters can get a jump on the competition

The housing market is unlikely to turn around soon, but this doesn’t mean that now is not a good time to buy or sell. It depends on your personal situation and market conditions in the area where you plan to buy or sell.

Become an expert on your local market. Knowing a good deal when you see it or what price to ask if you decide to sell depends on having a good understanding of how much properties are selling for in your neighborhood.

While you’re trying to decide what to do, line up a team that can help you accomplish your goal when you decide to move ahead. You can do this by researching online, attending open houses in the area and asking a real estate agent to keep you on top of market fluctuations.

Your decision to buy should be based on your personal financial situation, not on the national or global economy. For example, if you bought during the bubble market and are now getting divorced, you’ll probably sell for less than you paid.

But, if the house is too expensive for one to support, it may be cheaper in the long run to cut your losses and sell now. No one knows how long the housing downturn will last. Prices could move lower before rebounding. This is not an ordinary recession.

HOUSE-HUNTING TIP: Don’t get caught up following the herd. Just because most people in your area aren’t buying or are having difficulty selling doesn’t mean that you shouldn’t make a move. Just make sure if you’re a buyer that you have job security, a relatively healthy economy in your local area and a plan to stay put for at least 10 years.

The housing market will be volatile going forward. Good economic news will help fence-sitters make the decision to get serious about moving. Bad news of any sort can cause the market to stall. To take advantage of the upticks in the market, you need to be prepared in advance.

Find a good local real estate agent to work with who understands your needs, and wait to buy or sell until the time is right for you. It could take you a year or so to make the final decision. Some agents don’t have the patience to stick it out.

Select an agent who will educate you about the market and the idiosyncrasies of the home-sale business in your area. Ask to be kept informed about sales in the area. Many agents are set up to do this electronically, which is an easy way to keep you informed without taking up a lot of the agent’s time.

One of the most difficult aspects of the current home-sale business is financing the transaction. Find a loan agent or mortgage broker who is a real professional, has been in the business for years and who understands what current underwriters will require from you to process your loan.

Assemble all the financial documents you’ll need for loan approval even before you start looking. Ask your agent or broker to have your loan package previewed by an underwriter so that you know beforehand if there are any problems.

THE CLOSING: Remedy these in advance so that they don’t cause last-minute delays in closing.

From INMAN news: http://www.inman.com/buyers-sellers/columnists/dianhymer/6-tips-timing-a-real-estate-purchase

BofA Donates, Demolishes Houses

Bank of America Corp. (BAC), faced with foreclosed and abandoned houses it can’t sell, has a new tool to get rid of the most decrepit ones: a bulldozer.

BOA, the biggest U.S. mortgage servicer will donate 100 foreclosed houses in the Cleveland area. In some cases they will contribute to their demolition in partnership with a local agency that manages blighted property. The bank has similar plans in Detroit and Chicago, with more cities to come, and Wells Fargo & Co. (WFC), Citigroup Inc. (C), JPMorgan Chase & Co. (JPM) and Fannie Mae are conducting or considering their own programs.

Disposing of repossessed homes is one of the biggest headaches for lenders in the U.S., where 1,679,125 houses, or one in every 77, were in some stage of foreclosure as of June, according to research firm RealtyTrac Inc. of Irvine, California. The prospect of those properties flooding the market has depressed prices and driven off buyers concerned that housing values will keep dropping.

“There is way too much supply,” said Gus Frangos, president of the Cleveland-based Cuyahoga County Land Reutilization Corp., which works with lenders, government officials and homeowners to salvage vacant homes. “The best thing we can do to stabilize the market is to get the garbage off.”

BofA’s 40,000

Bank of America had 40,000 foreclosures in the first quarter, saddling the Charlotte, North Carolina-based lender with taxes and maintenance costs. The bank announced the Cleveland program last month, has committed as many as 100 properties in Detroit and 150 in Chicago, and may add as many as nine cities by the end of the year, said Rick Simon, a company spokesman.

The lender will pay as much as $7,500 for demolition or $3,500 in areas eligible to receive funds through the federal Neighborhood Stabilization Program. Uses for the land include development, open space and urban farming, according to the statement. Simon declined to say how many foreclosed properties Bank of America holds.

Ohio ranked among the top 10 states with the most foreclosure filings in June, according to RealtyTrac. The state has 71,617 foreclosed homes, Cuyahoga County 9,797 and Cleveland 6,778, RealtyTrac said.

The tear-downs are in varying states of disrepair, from uninhabitable to badly damaged. Simon said some are worth less than $10,000, and it would cost too much to make them livable.

Unwanted Homes

“No one needs these homes, no one is going to buy them,” said Christopher Thornberg, founding partner at the Los Angeles office of Beacon Economics LLC, a forecasting firm. “Bank of America is not going to be able to cover its losses, so it might as well give them away and get a little write-off and some nice public relations.”

Donating a house may create an income-tax deduction, said Robert Willens, an independent accounting analyst based in New York. A bank might deduct as much as the fair market value if a home wasn’t acquired with the explicit intent of knocking it down, he said.

Wells Fargo and Fannie Mae already started donating houses and demolition funds in Ohio. San Francisco-based Wells Fargo, the biggest U.S. home lender, gave 26 properties and $127,000 to the Cuyahoga land bank, said Russ Cross, Midwest regional servicing director for Wells Fargo Home Mortgage. Since 2009, Wells Fargo made more than 800 donations, the bank said.

Fannie Mae

Fannie Mae, the mortgage-finance company operating under U.S. conservatorship, made its first deal with the Cuyahoga land bank in 2009, and sells houses to the organization at a “very nominal value,” or about $1 and an additional $200 in closing costs, said P.J. McCarthy, who heads alternative disposition programs.

Fannie Mae sold 200 foreclosures to the Cuyahoga organization in 2010 and has similar programs in Detroit and Chicago. Cleveland is the only city where Washington-based Fannie Mae contributes $3,500 toward demolition, McCarthy said.

“It’s an economically justifiable transaction,” McCarthy said. “Holding on to a property that might sell for $1,000 or $2,000 or $5,000 for several hundred days is not in anybody’s best interest.”

JPMorgan, the second-biggest U.S. bank, has donated or sold at a discount almost 1,900 properties valued at more than $100 million in more than 37 states since late 2008, including 22 in Cleveland, said Jim O’Donnell, manager of community revitalization. The majority aren’t demolished, he said.

Nonprofit Role

since 2008, Citigroup has been donating foreclosures through the National Community Stabilization Trust, according to an e- mailed statement from Natalie Abatemarco, managing director for the bank’s office of homeownership preservation. The New York- based company, ranked third among U.S. lenders, is part of the Washington-based nonprofit trust’s pilot program that starts in late August to provide funds for purchases in distressed neighborhoods, and the money can be used toward demolition, Abatemarco said.

Demolishing all of Cleveland’s foreclosed and abandoned properties might cost $250 million, Frangos said. There are as many as 13,000, according to Case Western Reserve University in Cleveland and Neighborhood Progress Inc., working to counter, a nonprofit organization, the effects of foreclosures in six Cleveland areas, according to its website. The Cuyahoga County land bank owns about 899 properties and will demolish about 700 in the next six to seven months, Frangos said.

Blow Them Up

The oversupply of homes once prompted Warren Buffett, chairman and chief executive officer of Berkshire Hathaway Inc. (BRK/A), to quip in February 2010 that one solution was to “blow up a lot of houses — a tactic similar to the destruction of autos that occurred with the ‘cash-for-clunkers’ program.’”

Still, the knockdowns aren’t likely to outpace foreclosures, said Rick Sharga, RealtyTrac’s senior vice president. Foreclosures may accelerate as banks clear a backlog caused by soft real estate markets and legal disputes over tactics used to seize homes.

“These sorts of programs will basically only be nibbling on the edges,” Sharga said.

BOA, the biggest U.S. mortgage servicer will donate 100 foreclosed houses in the Cleveland area. In some cases they will contribute to their demolition in partnership with a local agency that manages blighted property. The bank has similar plans in Detroit and Chicago, with more cities to come, and Wells Fargo & Co. (WFC), Citigroup Inc. (C), JPMorgan Chase & Co. (JPM) and Fannie Mae are conducting or considering their own programs.

Disposing of repossessed homes is one of the biggest headaches for lenders in the U.S., where 1,679,125 houses, or one in every 77, were in some stage of foreclosure as of June, according to research firm RealtyTrac Inc. of Irvine, California. The prospect of those properties flooding the market has depressed prices and driven off buyers concerned that housing values will keep dropping.

“There is way too much supply,” said Gus Frangos, president of the Cleveland-based Cuyahoga County Land Reutilization Corp., which works with lenders, government officials and homeowners to salvage vacant homes. “The best thing we can do to stabilize the market is to get the garbage off.”

BofA’s 40,000

Bank of America had 40,000 foreclosures in the first quarter, saddling the Charlotte, North Carolina-based lender with taxes and maintenance costs. The bank announced the Cleveland program last month, has committed as many as 100 properties in Detroit and 150 in Chicago, and may add as many as nine cities by the end of the year, said Rick Simon, a company spokesman.

The lender will pay as much as $7,500 for demolition or $3,500 in areas eligible to receive funds through the federal Neighborhood Stabilization Program. Uses for the land include development, open space and urban farming, according to the statement. Simon declined to say how many foreclosed properties Bank of America holds.

Ohio ranked among the top 10 states with the most foreclosure filings in June, according to RealtyTrac. The state has 71,617 foreclosed homes, Cuyahoga County 9,797 and Cleveland 6,778, RealtyTrac said.

The tear-downs are in varying states of disrepair, from uninhabitable to badly damaged. Simon said some are worth less than $10,000, and it would cost too much to make them livable.

Unwanted Homes

“No one needs these homes, no one is going to buy them,” said Christopher Thornberg, founding partner at the Los Angeles office of Beacon Economics LLC, a forecasting firm. “Bank of America is not going to be able to cover its losses, so it might as well give them away and get a little write-off and some nice public relations.”

Donating a house may create an income-tax deduction, said Robert Willens, an independent accounting analyst based in New York. A bank might deduct as much as the fair market value if a home wasn’t acquired with the explicit intent of knocking it down, he said.

Wells Fargo and Fannie Mae already started donating houses and demolition funds in Ohio. San Francisco-based Wells Fargo, the biggest U.S. home lender, gave 26 properties and $127,000 to the Cuyahoga land bank, said Russ Cross, Midwest regional servicing director for Wells Fargo Home Mortgage. Since 2009, Wells Fargo made more than 800 donations, the bank said.

Fannie Mae

Fannie Mae, the mortgage-finance company operating under U.S. conservatorship, made its first deal with the Cuyahoga land bank in 2009, and sells houses to the organization at a “very nominal value,” or about $1 and an additional $200 in closing costs, said P.J. McCarthy, who heads alternative disposition programs.

Fannie Mae sold 200 foreclosures to the Cuyahoga organization in 2010 and has similar programs in Detroit and Chicago. Cleveland is the only city where Washington-based Fannie Mae contributes $3,500 toward demolition, McCarthy said.

“It’s an economically justifiable transaction,” McCarthy said. “Holding on to a property that might sell for $1,000 or $2,000 or $5,000 for several hundred days is not in anybody’s best interest.”

JPMorgan, the second-biggest U.S. bank, has donated or sold at a discount almost 1,900 properties valued at more than $100 million in more than 37 states since late 2008, including 22 in Cleveland, said Jim O’Donnell, manager of community revitalization. The majority aren’t demolished, he said.

Nonprofit Role

since 2008, Citigroup has been donating foreclosures through the National Community Stabilization Trust, according to an e- mailed statement from Natalie Abatemarco, managing director for the bank’s office of homeownership preservation. The New York- based company, ranked third among U.S. lenders, is part of the Washington-based nonprofit trust’s pilot program that starts in late August to provide funds for purchases in distressed neighborhoods, and the money can be used toward demolition, Abatemarco said.

Demolishing all of Cleveland’s foreclosed and abandoned properties might cost $250 million, Frangos said. There are as many as 13,000, according to Case Western Reserve University in Cleveland and Neighborhood Progress Inc., working to counter, a nonprofit organization, the effects of foreclosures in six Cleveland areas, according to its website. The Cuyahoga County land bank owns about 899 properties and will demolish about 700 in the next six to seven months, Frangos said.

Blow Them Up

The oversupply of homes once prompted Warren Buffett, chairman and chief executive officer of Berkshire Hathaway Inc. (BRK/A), to quip in February 2010 that one solution was to “blow up a lot of houses — a tactic similar to the destruction of autos that occurred with the ‘cash-for-clunkers’ program.’”

Still, the knockdowns aren’t likely to outpace foreclosures, said Rick Sharga, RealtyTrac’s senior vice president. Foreclosures may accelerate as banks clear a backlog caused by soft real estate markets and legal disputes over tactics used to seize homes.

“These sorts of programs will basically only be nibbling on the edges,” Sharga said.

Freddie Mac ready to launch Servicing Success Program

Monday, July 25th, 2011, 5:09 pm

Freddie Mac posted details about its new Servicing Success Program Monday as the government-sponsored enterprise prepares for the Aug. 1 launch of the initiative.

Through the program, Freddie hopes to offer servicers a more "robust and balanced approach" to setting standards for what the GSE expects from its servicing clients in the field.

The program will not only set performance bars, but will provide a stream of feedback on servicer strengths and weaknesses. It also will allow for open dialogue to give servicers the information they need to improve the performance of their portfolios.

Freddie's Servicing Success Program directly evaluates each servicer's performance when it comes to investor reporting, remitting and default management.

Through the program, Freddie will rank servicers monthly based on points they earned when servicing loans the previous month. The August rankings will be available on each servicer's performance profile Web page starting Oct. 7. This ranking system will replace Freddie's traditional performance-tiered rankings.

"Today's announcement marks the beginning of a significant advance in the scope and sophistication of servicer performance management," said Tracy Mooney, senior vice president of single-family servicing and REO at Freddie Mac. "The robust, balanced approach we are launching in 2011 underscores Freddie Mac's commitment to invest in the future of U.S. homeownership by strengthening servicing practices and enabling servicers to more effectively preserve homeownership."

http://www.housingwire.com/2011/07/25/freddie-mac-ready-to-launch-servicing-success-program

Wednesday, July 27, 2011

Hud 93727

7333 EAST CORTLAND Fresno 93727

$165,000

For more information give Green HouseProperties a call at 559-478-2090

Julie Salinas

01440468

Ocwen Financial Offers New Loan Modification Program

The Shared Appreciation Modification (SAM) program reduces a delinquent borrower’s principal to 95 percent of the home’s current market value but requires the homeowner to later share 25 percent of the home’s appreciation with the investor when the home is eventually sold or refinanced.

The portion of the debt that is written down is forgiven over the following three years in three, equal increments, provided the borrower remains current the modified mortgage payments.

“Like all modifications, SAMs help homeowners avoid foreclosure. But they also restore equity. That’s a significant benefit to the customer and, we believe, the economy and housing market,” Ocwen CEO Ronald Faris.

“Psychologically, it’s important too,” Faris adds. “Our analytics tell us that an underwater mortgage is one-and-a-half to two-times more likely to default than one with at least some positive equity.”

Ocwen launched a pilot SAM program in August 2010 and is now expanding the program to 33 states.

“Ocwen is to be applauded for this visionary program. They have created a win-win situation for all involved,” said Marcia Griffin, President of HomeFree-USA, a community-based organization focused on homeownership development.

“The homeowner benefits from a stable housing situation and the investor is positioned to share in the future appreciation of the home’s value. In addition, communities nationwide will benefit from fewer foreclosures,” she continued.

The SAM program also received praise from John Taylor, President and CEO of the National Community Reinvestment Coalition.

“We hope this innovative effort inspires other mortgage servicers to follow suit, because fixing the housing market is the best way to bring back jobs and revitalize the American economy,” Taylor said.

In total, Ocwen has modified more than 200,000 loans to keep homeowners out of foreclosure since the mortgage crisis began.

Ocwen has completed 25 times as many loan modifications per serviced loan as the overall industry.

The Atlanta, Georgia-based company has a $74 billion residential servicing portfolio and is continuing to expand.

Ocwen Financial Corporation provides both residential and commercial servicing as well as special servicing and asset management

The portion of the debt that is written down is forgiven over the following three years in three, equal increments, provided the borrower remains current the modified mortgage payments.

“Like all modifications, SAMs help homeowners avoid foreclosure. But they also restore equity. That’s a significant benefit to the customer and, we believe, the economy and housing market,” Ocwen CEO Ronald Faris.

“Psychologically, it’s important too,” Faris adds. “Our analytics tell us that an underwater mortgage is one-and-a-half to two-times more likely to default than one with at least some positive equity.”

Ocwen launched a pilot SAM program in August 2010 and is now expanding the program to 33 states.

“We think this program can make a real impact on curing the negative equity problem, and are working hard to obtain approvals for SAMs in all jurisdictions,” added Faris.

The pilot program achieved a 79 percent borrower acceptance rate, and only 2.63 percent of loans redefaulteld, according to Faris.“Ocwen is to be applauded for this visionary program. They have created a win-win situation for all involved,” said Marcia Griffin, President of HomeFree-USA, a community-based organization focused on homeownership development.

“The homeowner benefits from a stable housing situation and the investor is positioned to share in the future appreciation of the home’s value. In addition, communities nationwide will benefit from fewer foreclosures,” she continued.

The SAM program also received praise from John Taylor, President and CEO of the National Community Reinvestment Coalition.

“We hope this innovative effort inspires other mortgage servicers to follow suit, because fixing the housing market is the best way to bring back jobs and revitalize the American economy,” Taylor said.

In total, Ocwen has modified more than 200,000 loans to keep homeowners out of foreclosure since the mortgage crisis began.

Ocwen has completed 25 times as many loan modifications per serviced loan as the overall industry.

The Atlanta, Georgia-based company has a $74 billion residential servicing portfolio and is continuing to expand.

Ocwen Financial Corporation provides both residential and commercial servicing as well as special servicing and asset management

The Coolest Small Cities in America

Courtesy of follybeach.com

More from GQ

Want a real break? Forget the hassle of getting in and out of America’s metropolises—with their $400 hotel rooms and mobbed tourist attractions. Instead, hit these miniopolises, where top-notch food comes straight from the farm and your third round is on the house. Here are eight reasons to downsize your next vacation.Charleston, South Carolina

Mind-blowing shrimp ‘n’ grits just minutes from an awesome southern surf scene. To wake up under the ornate fourteen-foot ceilings of the Wentworth Mansion is to wonder if some southern heiress took you home with her the night before. The stately digs were once the city’s finest home, and they make you feel not like you live in Charleston but like you own it.Plus, you’re within walking distance of the Hominy Grill and its unparalleled shrimp ‘n’ grits—a dish that earns its place on breakfast, brunch, and lunch/dinner menus, and makes you want to stretch out on your daybed at the Mansion.

Instead, follow signs to Folly Beach and keep heading east along the water until you’re past the cars parked under the palmetto trees. You can sleep off breakfast in the sun, but between the temperate climate and generally mellow swell, it’s a good place to pick up surfing—or to shred if you can. Southern hospitality extends to the water: You won’t find friendlier locals on the East Coast.

Portland, Maine

You can walk anywhere in this town — even in December. Here are your marching orders.Fore Street is one of America’s best restaurants, but skip the dining room for a dozen oysters at the bar—where the barmen greet you as if it were your private club—and wash them down with an iced Maine vodka or a microbrew. You’re a three-minute walk from the happy-hour crowd at J’s Oyster, which offers a harbor view, oysters for $7 per half dozen, and Christmas lights that never come down.

It’s a forty-minute ferry ride to Diamond Cove—the kind of island where George H. W. Bush pulls up on his cigarette boat. The lobster roll from the Diamond Cove General Store involves an entire lobster, steamed to order. Crisscross the island on footpaths (no cars are allowed) and, at low tide, trek across a sandbar to Little Diamond Island to catch the ferry back.

Santa Fe, New Mexico

The air is thin in the country’s highest state capital, but it’s always perfect riding weather here. Mount up a dual-suspension Rocky Mountain 29er at Mellow Velo, because extra-large wheels carry momentum on swoopy high-desert terrain and city streets alike. It’s a fifteen-minute pedal to Cerro Gordo Road, where a left turn after the pavement ends will dump you into the Dale Ball Trails, a well-marked thirty-mile network of single-track. If you’re just in from sea level, don’t feel bad when women jogging with their dogs zip past you.The Anasazi Indians of New Mexico were cliff dwellers—pioneers of early civilization’s precursor to the apartment building. Rosewood Inn of the Anasazi, with its sandstone walls, kiva fireplaces, and handwoven carpets, is a boutique tribute to their ingenuity, and the best hotel in town.

Providence, Rhode Island

For years, Providence has been heralded as the arts-and-culture center of New England—in large part by developers who dreamed of replacing the resident artists with Boston yuppies. Thankfully, that dream is dead. Because what Providence lacks in fratty Irish bars, it makes up for with a vibrant art scene and the renegade character of a bastard son.Nights out begin at AS220, a downtown restaurant, gallery, and art studio—before moving across the highway to West Side bars like the pleasantly divey E&O Tap or Julian’s, the epicenter of Providence’s scene, where paintings by local artists deck the walls and everyone knows—and likely plays in a band with—everyone else.

The next day, you’ll find the same crowd recovering down the street over brunch at Nick’s. While you’re waiting for a table, browse the shelves at Armageddon Shop, purveyor of Providence-made music and the city’s iconic Technicolor silk-screened posters. The clerks may give you a funny look if you tell them you’re “on vacation” in Providence; better to say you’re just avoiding Boston.

Raleigh, North Carolina – Poole’s Downtown Diner

Poole’s serves late on Saturday night, and even though you’re stuffed with macaroni au gratin and buttermilk fried chicken, you ask the hostess what time they start serving Sunday brunch. It’s the triumph of logic over satiation: You will have to eat tomorrow, and this is clearly the best food in town. The polished retro space—once an honest-to-God diner—looks just as good in daylight. The crispy catfish entrée is re-imagined as a BLT; the wine list loses none of its appeal. You’d have to wait till Monday to catch another dinner, which seems like not a bad idea.Courtesy of ulterior epicure/Flickr

Boulder, Colorado – Frasca

A frasca is an old-school farmers’ hangout in Friuli, Italy, but Frasca the restaurant, in a posh piece of Boulder, is a happy cult of new-world Friulian obsessives. Led by chef Lachlan Mackinnon-Patterson, they’re riffing on the culinary heritage of the Italian region using Colorado’s finest produce. If you put Frasca in downtown Manhattan, it would compete with the best Italian restaurants in the city. If you put it in the middle of Friuli, the locals would likely recognize a reflection of their better culinary selves and travel to pay homage, just as we do.Athens, Georgia